OUR ONLINE CREDIT APPLICATION SERVICES

Welcome to our online credit application platform, where we are committed to providing an exceptional experience for each and every one of our customers. Our goal is to provide you with a simple, fast and secure process to meet your financial needs.

Why choose our services?

Simplicity and Speed

Intuitive interface: Our platform is designed to be easy to navigate, even for novice users. Every step of the process is clearly explained.

Fast process: We understand the importance of time. That’s why we’ve optimized our system so that you can complete your application in just a few minutes.

Security & Privacy

Secure Data: We use the latest encryption technologies to ensure the security of your personal information.

Confidentiality Guaranteed: Your information is strictly confidential and will never be shared without your consent.

Personalized support

Dedicated Customer Service: Our team is available to answer all your questions and guide you through the process.

Personalized advice: We offer advice tailored to your financial situation to help you make the best choices.

How does it work?

Account Creation: Register on our platform by providing your basic information.

Application Submission: Complete the online application form with the required details.

Rapid Evaluation: Our system evaluates your application and provides you with a response in record time.

Decision and Follow-up: Receive your credit decision and track the status of your application in real time.

Customer Testimonials

“I was impressed with the speed and simplicity of the process. I highly recommend their services.” – Marie Dupont

“The customer service is exceptional. They answered all my questions with patience and professionalism.” – Jean Martin

We look forward to providing you with an online credit application experience that exceeds your expectations. Trust us to guide you through your financial projects with efficiency and transparency.

- In today’s modern world, financial management has become more accessible thanks to technology. Online credit application services offer a fast and convenient solution for those seeking financial support. Here’s an overview of the services we offer to help you with your online credit application.

- Benefits of our Services

Speed and efficiency

We understand the importance of time. That’s why our application process is designed to be fast, allowing you to submit your application in just a few minutes.

Accessibility

Our online platform is accessible 24/7, allowing you to apply at any time that’s convenient for you, without having to travel.

Confidentiality and security

We guarantee the confidentiality of your personal information thanks to advanced security protocols. Your data is protected throughout the entire process.

- Personalized support

Our advisors are on hand to guide you through the application process. They will provide you with personalized advice to help you make the best financial decisions.

- Types of credit

Credit is an essential financial tool that enables individuals and businesses to access funds for a variety of purposes, from buying a home to setting up a business. There are several types of credit, each with its own characteristics and uses. Here’s an overview of the main types of credit. - Consumer credit

Consumer credit is designed for individuals to finance personal purchases. It is often used for consumer goods such as cars, household appliances or vacations. - Types of consumer credit

Unrestricted consumer credit: This type of credit can be used freely by the borrower for any purchase. - Affected credit: This type of credit is specifically linked to a particular purchase, such as a car or student loan.

- Revolving credit: Also known as revolving credit, this allows the borrower to have a sum of money at their disposal which they can use as and when they need it, with generally smaller amounts and higher interest rates.

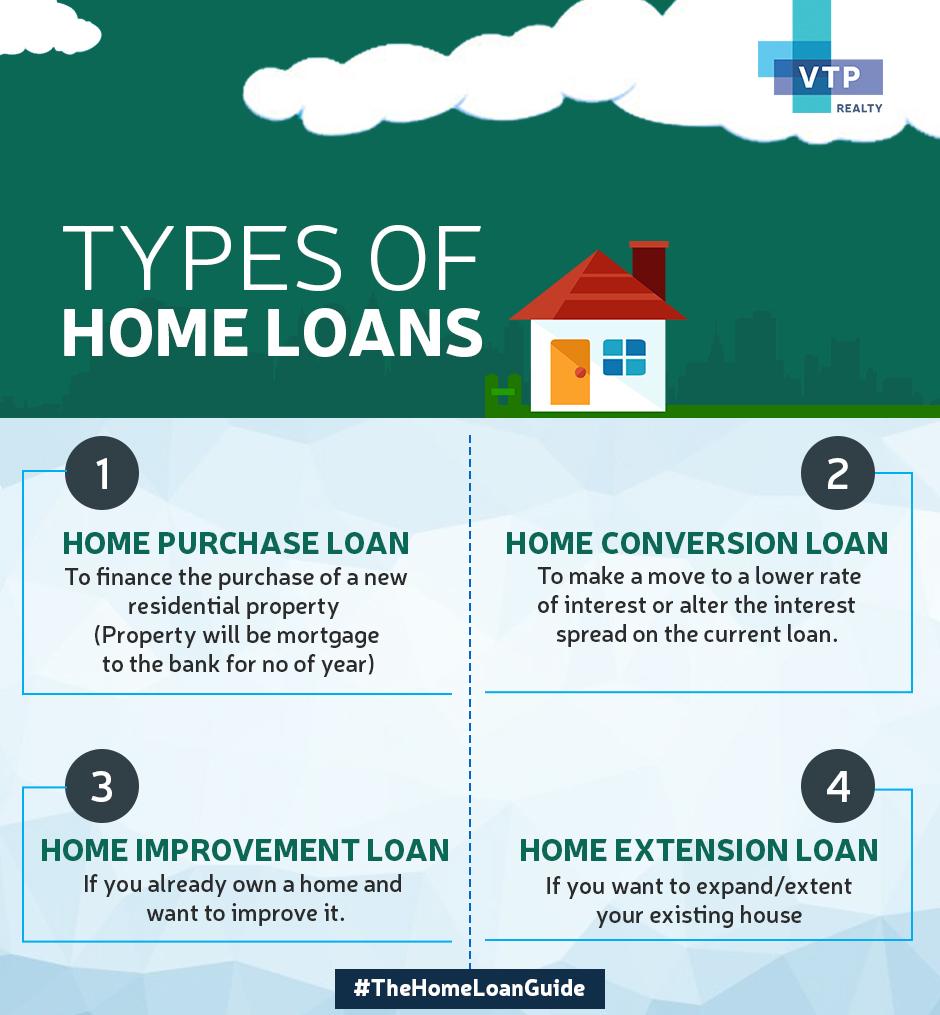

- Real estate credit

Real estate loans are used to purchase real estate. It generally involves large sums, with a long repayment period, often up to 30 years.

Types of mortgages

Mortgage loan: This type of loan is secured by the property purchased. If the borrower is unable to repay the loan, the bank can seize the property.

- Bridging loan: This loan is designed for people who wish to buy a new property before selling their old one. It enables you to finance the purchase temporarily.

- Business credit

Companies use credit to finance their operations, expand their business or invest in new projects. - Types of business credit

Operating credit: Used to finance day-to-day business needs, such as purchasing raw materials or paying salaries. - Investment credit : Used to finance long-term projects, such as the purchase of new machinery or the opening of a new branch.

- Leasing: Allows a company to lease an asset with an option to purchase at the end of the lease. It is often used for expensive equipment.

Understanding the different types of credit is essential to making informed financial choices. Each type of credit has its own conditions, advantages and disadvantages. It’s important to analyze your financial needs and repayment capacity before taking out credit.